24 March 2017

* Location - Do you want to be able to keep an eye on the building or will you appoint a Managing Agent?

* Property Type - Retail, office, industrial, leisure – budget may dictate this or maybe the return will?

* Return - What yield are you looking for – as low as 5% for a national tenant on a 15 year lease or an independent retailer in a small tertiary shop 10%+ on a short term 3 year lease?

* Purpose - Do you want steady, low risk income, then you need a strong covenant as the tenant. Are you happy to asset manage by surrendering a commercial lease where upper parts are not in use and you then convert this to residential?

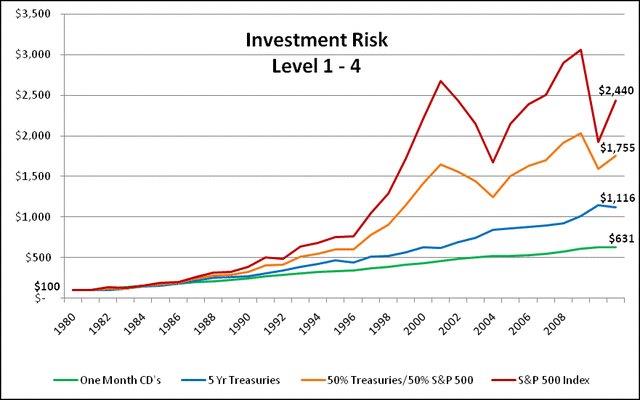

Whilst we may be viewed as biased we feel commercial property returns are well above interest earnt on money in the bank and are an investment well worth making.

Should you require any assistance please contact Paul Stewart, Managing Director of Goadsby Commercial on 01202 550000.